What is a Pre-Authorized Contribution (PAC) plan?

With a PAC, a pre-arranged amount is automatically withdrawn from your chequing account on a regular timeframe, such as weekly, biweekly, semi-monthly or monthly, then deposited directly into your investment account. You decide how much and how often to save, and can start with as little as $25 a month.

Why use a PAC?

Market fluctuations make it difficult for most investors (and even many professional investment managers) to determine precisely when to capitalize on an investment. However, with a PAC, you can benefit from a useful investment technique called “dollar cost averaging”.

Dollar cost averaging means you’ll be investing a fixed-dollar amount at regularly-scheduled intervals, while also taking into account market fluctuations. When the unit price is high, your fixed investment will buy fewer mutual fund units. When the price drops, it will, in turn, buy more units. In doing so, your average unit cost will be lower, and you’ll be eliminating the risk of investing in the market at the wrong time. Plus, the longer you choose to take advantage of dollar cost averaging – such as a period of 5-10 years for example – the more lucrative it will prove to be.

Wondering how to get started with your PAC?

1. Choose the amount you’d like to invest

- Decide on an amount that suits your budget – even the minimum contribution of $25 a month will get you on the right track.

- Keep in mind that you can raise or lower your contribution at a later time (minimum contribution is set at $25).

2. Create your investment plan

- Educators Financial Group offers free financial planning.

- Set up a meeting with one of our financial specialists to help you create an investment plan that suits your financial goals and risk profile.

3. Select your preferred payments dates

- PACs offer flexibility, so you can align it with payroll deposits, RRIF payments, automated bill payments or any other way that’s most convenient for you.

4. Take care of your RRSP contribution in advance

- By year-end, tally up your total contributions for your RRSP.

- Avoid the hassle and high cost of borrowing money to make your RRSP contribution.

5. Get started right away

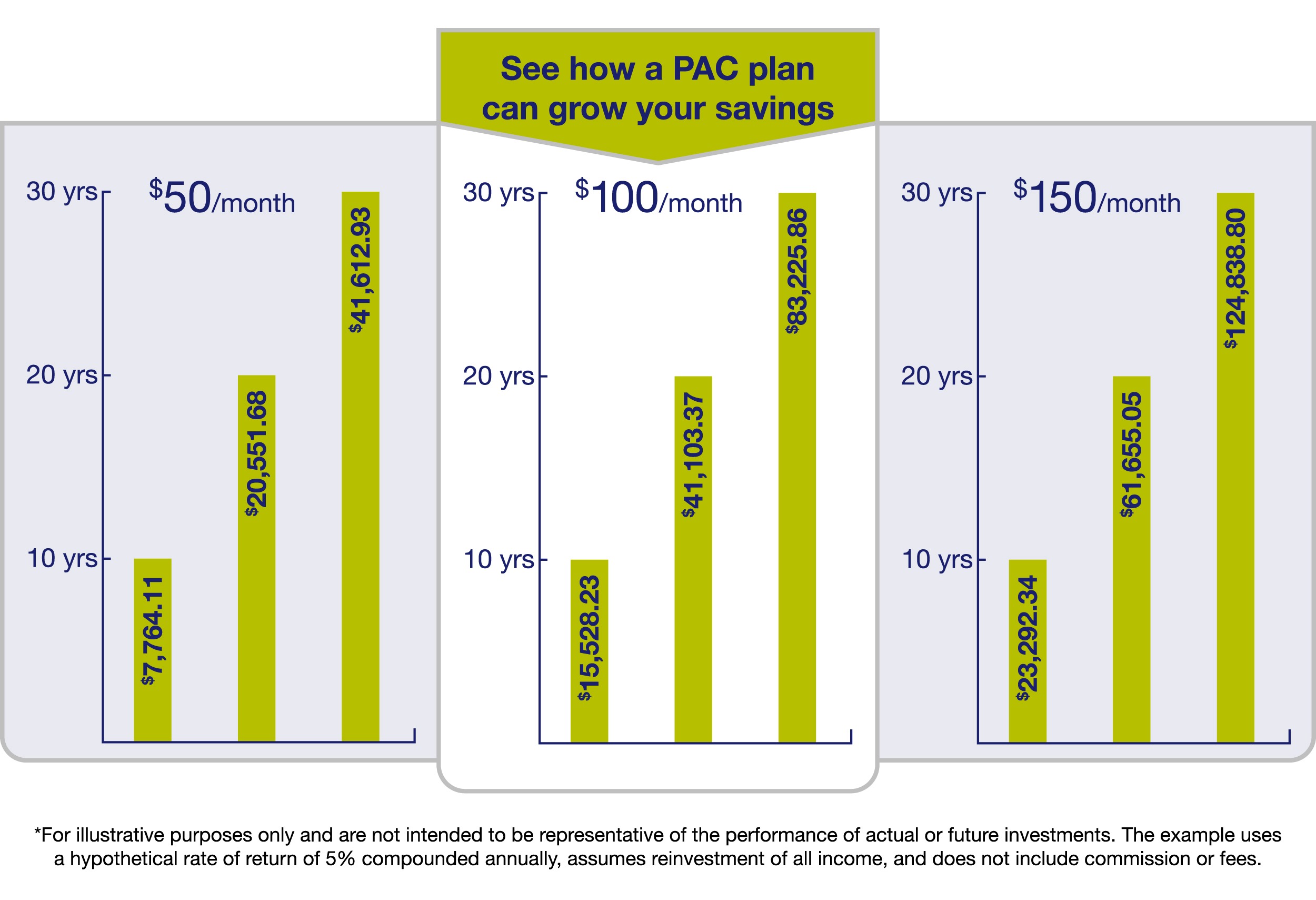

- The sooner you contribute, the sooner your investment will grow.

Are you ready to set-up a PAC?

Complete the application form or speak to one of our financial specialists today.