Taking a leave? You should understand pension buybacks.

(Reading time: 3:00)

One of the great perks of being an education professional is your pension.

Whether it comes from the Ontario Teachers’ Pension Plan (OTPP) or Ontario Municipal Employees Retirement System (OMERS)—that pension brings with it a unique feeling of financial security in retirement. Yet true financial security also requires doing a bit of homework. Because, like any area of your finances, you need to understand how your pension works to ensure you maximize its benefits.

For example, did you know that your pension would be affected if you go on leave?

This is for the simple reason that if/when you take a leave, you don’t make pension contributions. This would leave you with a bit of a pension income gap (i.e., your pension would be reduced, unless you made up the contributions you missed).

This is why catching up on your pension contributions makes sense.

Let’s take the Ontario Teachers’ Pension Plan, for example—“Your OTPP is an excellent benefit to have for your retirement”, says Michail Tsirikos, Senior Financial Advisor with Educators Financial Group. “Since its inception, it has been called the best-performing pension fund in the world*—that’s pretty impressive. When you retire, the income you receive from it is secure, because it is determined by a formula—not the ups and downs of the market”.

To Michail’s point above, having such a unique (and high-performing) pension benefit means you’ll want to maximize the income you’ll receive from OTPP in retirement.

This means catching up on any missed contributions (also referred to as lost ‘pension credits’).

There are two ways to catch up on lost pension credits due to a leave.

First, you can work another year before retiring—but who knows whether you’ll want to, or will be in a position to, when the time comes.

Second, you can make up for gaps in your pension by paying for your leave, which is called a buyback. This covers leaves that could be described as:

- Maternity, parental, and adoption

- Approved by your employer

- Going back to school

- Caring for a loved one

- Teaching in another province

A buyback has many financial advantages.

With a buyback, you’ll receive the maximum amount of pension you’re eligible for.

That’s great news, considering educators typically enjoy a longer-than-average retirement—up to 30 years according to the Ontario Teachers’ Pension Plan.

According to the OTPP, making up a year’s gap in your pension typically costs approximately $10,000 (based on a full-time salary of $85,000). Paying for that leave could increase your pension by about $1,900 a year—or by as much as $57,000 over the course of your retirement.

Maximizing your OTPP also means providing added security for loved ones—because the greater your pension, the greater your survivor benefit.

The icing on the cake: your buyback – like all contributions to your pension plan – is matched by your employer. This essentially translates to you paying for just 50% of your retirement.

Along with the advantages, there are also a few challenges to a pension buyback.

“When you’re returning to work after a leave, you’ll probably have many expenses you haven’t had for a while—such as the cost of commuting, new clothing, and perhaps even childcare. So, finding the money to buyback your pension may be a challenge”, says Michail Tsirikos. “However, you do have some flexibility. You can buy back as little or as much as you want and you can make those payments in a lump sum or installments. Also, your RRSP can be used to pay for the buyback.”

In addition, you have up to five years from the end of your leave to make the buyback. Keep in mind that if you’re paying in installments, the faster you make those buybacks, the less interest you’ll pay.

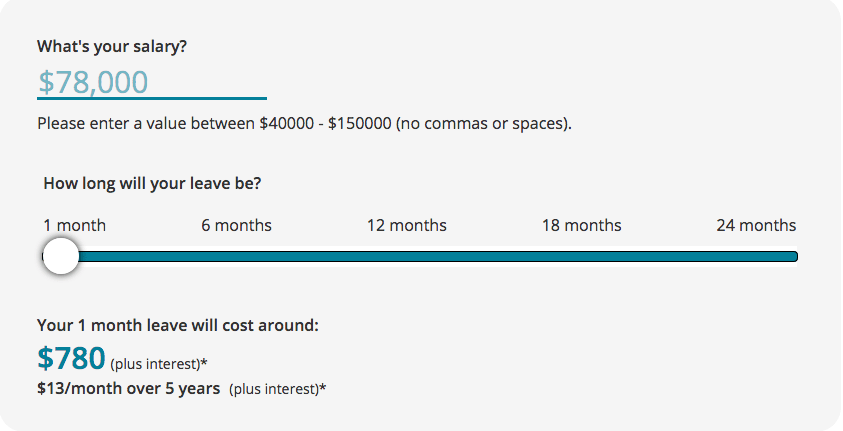

How much is a typical buyback?

According to the OTPP website, the buyback for a year’s gap in pension will cost between $6,000 and $12,000.

The formula calls for multiplying the salary you earned before your leave by the contribution rate(s) for the leave period you’re paying for (2021’s contribution rate is 12%).

Here’s an example:

Interest on the amount starts to accumulate when your leave ends (interest rates have recently hovered below 2% but can change, and may increase, before you finish paying for your leave).

How buyback payments work.

First, if you decide to buyback your leave, you must advise the OTTP by April 30th of the year after your leave. Visit the OTTP’s Buyback Centre to start the process.

As we alluded to previously, you can pay for your leave with cash, RRSPs, or a mixture of both.

If you’re paying by cash: you can do it through online banking or post-dated cheques (and you may even get a tax deduction).

If you’re using money from your RRSP: keep in mind that you won’t get a tax break (because you’re moving money from one tax-sheltered plan to another)—here’s the form you’ll need to take to your financial institution that holds your RRSP.

A buyback will affect your RRSP room.

One of the caveats to using your RRSP for buyback payments is that you won’t regain the RRSP contribution room for the amount that you’re putting toward your leave.

The Canada Revenue Agency (CRA) looks at how much you contribute to your pension in a calendar year and what those contributions are worth as a pension benefit; then reduces your RRSP room by that amount. This is called a pension adjustment.

For example, a full-time teacher making about $78,000 who pays about $10,000 for their leave would have a pension adjustment of around $14,000. Their RRSP contribution room would be reduced by that amount (i.e., $14,000). The reduction to your contribution room is larger than the cost of your leave, because the CRA calculates the value that paying for your leave will add to your pension.

Need help understanding pension buybacks? Talk to an Educators financial specialist.

Since 1975, Educators Financial Group has been helping education professionals with all of their financial dreams, goals, and dilemmas. When it comes to saving for and managing your income in retirement, we can answer all your questions. Since we know exactly how your pension works (i.e., OTPP/OMERS), we can provide you with educator-specific advice on how to maximize your benefits and live the retirement you deserve.

Click here to have one of our financial specialists contact you.

Sources:

https://thewalrus.ca/pension-envy/

https://www.otpp.com/members/cms/en/life-career-events/taking-time-off/cost-and-payment-options.html